Companies should carefully assess whether such information is truly “new” information identified in the reporting period or corrects inappropriate assumptions or estimates in prior periods (which would be evaluated under the error correction guidance in Section 2). For example, a change made to the allowance for credit losses to include data that was accidentally omitted from the original estimate or to correct a mathematical error or formula represents an error correction. Conversely, a change made to the same allowance to incorporate updated economic data (e.g., unemployment figures) and the impact it could have on the customer population would represent a change in estimate. Under the iron curtain method, the effect on the income statement to correct the error would be a debit of $100 to expense in the interim period and a credit to the accrued liability for the $100 at the end of Year 4 on the balance sheet. Since the iron curtain method doesn’t account for any effects on prior periods, the company ignores the $75 of expenses it would have captured in retained earnings if it had recorded the bonus accrual of $25 as incurred each year. For investors, security analysts, or other users of financial statements, changes in accounting principles can be confusing to read and understand.

- An SEC registrant will generally correct the error(s) in such statements by amending its Annual Report on Form 10-K and/or Quarterly Reports on Form 10-Q (i.e., filing a Form 10-K/A and Form 10-Q/As for the relevant periods).

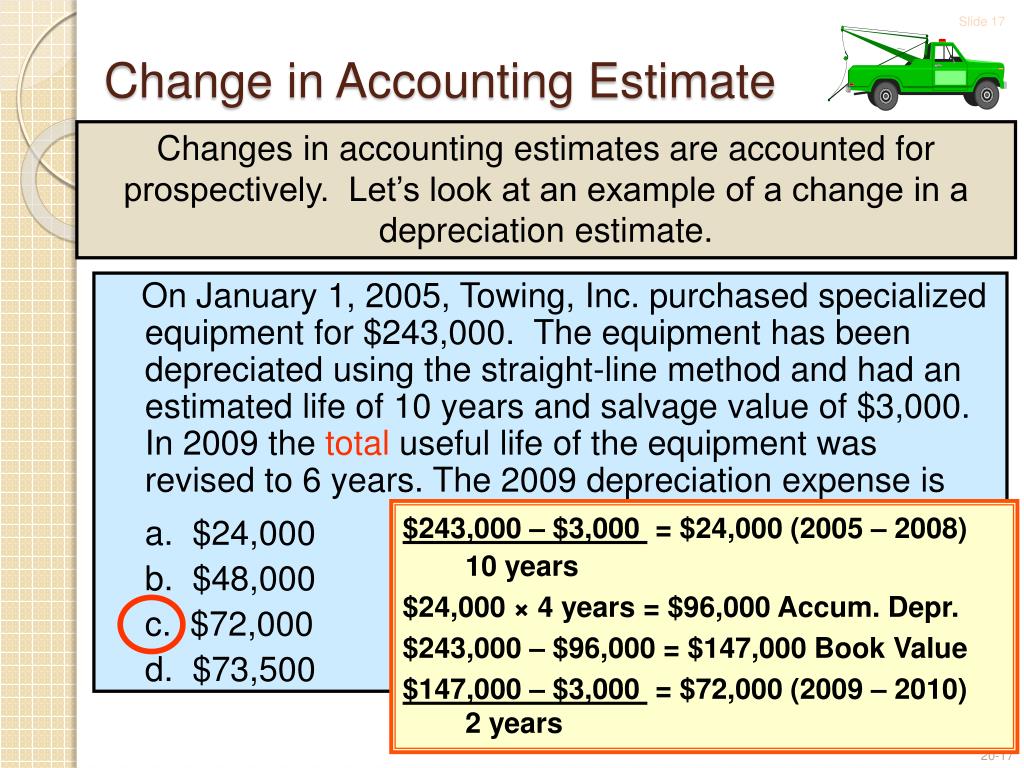

- An example of an accounting estimate change could be the recalculation of the machine’s estimated lifetime due to wear and tear or technology devices and systems due to faster obsolescence.

- Our publication provides some key disclosure and reporting reminders for upcoming filings and summarizes the SEC’s rulemaking and other activities that affect financial reporting.

- A fundamental pillar of high quality financial reporting is reliable and comparable financial statements that are free from material misstatement.

- If the change in estimate does not have a material effect in the period of change, but is expected to in future periods, any financial statements that include the period of change should disclose a description of the change in estimate.

Internal Controls Over Financial Reporting

When it comes to determining materiality, the process largely depends on the entity itself. Materiality assessments aren’t standardized for all entities, so different factors will influence their outcome. Granted, many companies solely focus on a quantitative measurement of materiality – like a percentage of pretax net income – but this isn’t the only appropriate way to determine materiality. In these situations, management should work closely with its securities counsel and auditors and may need to discuss its approach with the SEC staff, stock exchanges, or other regulatory agencies about the measures to be taken given the facts and circumstances. 1 Measurement uncertainty is defined in the Appendix to the 2018 Conceptual Framework as the ‘uncertainty that arises when monetary amounts in financial reports cannot be observed directly and must instead be estimated’.

The Future of AI Is Now. Is Tax Ready?

In financial statements which reflect both error corrections and reclassifications, clear and transparent disclosure about the nature of each should be included. Out-of-period adjustment – An error is corrected within the current period as an out-of-period adjustment when it is considered to be clearly immaterial to both the current and prior period(s). However, there may be circumstances in which the out-of-period adjustment stands out (e.g., it appears as a reconciling item in the rollforward of an account balance) that may warrant consideration of disclosure about the item’s nature. A fundamental pillar of high quality financial reporting is reliable and comparable financial statements that are free from material misstatement.

About GAAPology

Security analysts, portfolio managers, and activist investors watch carefully for changes in accounting principles, as these are often early warning signs of deeper issues. A change in an accounting principle can be fairly routine, especially as the state of business has changed due to globalization, the digitization of business models, and shifting consumer preferences. To keep interested stakeholders well informed, public relations and strategic communications teams often help explain the rationale behind a change in accounting methods—which can often make perfect finance and accounting sense. Accounting estimates are monetary amounts in financial statements that are subject to measurement uncertainty. An example of an accounting estimate would be a loss allowance for expected credit losses when applying IFRS 9, Financial Instruments.

Accounting Changes Under ASC 250

Here, the effect of the change in accounting principle – the depreciation method – could be inseparable from the impact of the change in accounting estimate. Since these types of changes relate to the continuing process of obtaining additional information and revising estimates, they are considered a change in estimate. Additionally, if an error correction is not material to the estimated income of the full fiscal year or earnings trends, but the adjustment is material to the interim period, the correction should be separately disclosed in the interim financial statements. There are different and less stringent reporting requirements for changes in accounting estimates than for accounting principles. In some cases, a change in accounting principle leads to a change in accounting estimate; in these instances, the entity must follow standard reporting requirements for changes in accounting principles. Distinguishing between accounting policies and accounting estimates is important because changes in accounting policies are generally applied retrospectively, while changes in accounting estimates are applied prospectively.

Whenever a change in principles is made by a company, the company must retrospectively apply the change to all prior reporting periods, as if the new principle had always been in place, unless it is impractical to do so. This is known as «restating.» Keep in mind that these requirements only impact direct effects, not indirect effects. As the prior period financial statements are not determined to be materially misstated, the entity is not required to notify users that they can no longer rely on the prior period financial statements. Accounting principles are general guidelines that govern the methods of recording and reporting financial information. When an entity chooses to adopt a different method from the one it currently employs, it is required to record and report that change in its financial statements.

In general, changing from the iron curtain to the dual method is preferable since, once again, it provides a more holistic assessment. However, moving in the opposite direction can have a reverse effect, potentially eliminating some transparency and clarity for financial statement users. However, if it wants to change change in accounting principle inseparable from a change in estimate the evaluation method, it would need to be assessed under the premise of a change in accounting principle. However, some private companies may consider changing an accounting principle – for example, a private company alternative – to one required for public companies before filing an IPO registration statement.

Accounting changes and errors in previously filed financial statements can affect the comparability of financial statements. A change from one generally accepted accounting principle to another generally accepted accounting principle when there are two or more generally accepted accounting principles that apply or when the accounting principle formerly used is no longer generally accepted. A change in the method of applying an accounting principle also is considered a change in accounting principle. Luna Bank accounts for the investment at fair value through profit or loss in accordance with IFRS 9.

They need adjustments in order to compare, apples to apples, the pre-change, and the post-change numbers, to be able to derive correct insights. The adjustments look very similar to error corrections, which often have negative interpretations. Changes in accounting estimates don’t require the restatement of previous financial statements. If the change leads to an immaterial difference, no disclosure of the change is required. According to the SEC, the disclosures should facilitate as much transparency as possible, where changes and corrections should be easy for financial statement users to understand. Also, if an entity does not present comparative financial information, it must disclose the impact on the opening balance of retained earnings and net income – including the related income tax effect – for the immediately preceding period.

The company inadvertently forgot to record this accrual and identifies the error in the current year – Year 4. Further, the company only presents two fiscal years of comparative financial statements and found no other errors. Now we get to the area of ASC 250 that give CFOs night sweats – accounting errors and the impact they can have on financial statements.

Our publication provides some key disclosure and reporting reminders for upcoming filings and summarizes the SEC’s rulemaking and other activities that affect financial reporting. The two statements above were added to help further clarify the logic used in our example. The guidance says that an estimate may need to change if new information becomes available, and that’s just what Luna did! Our case facts explained that Luna felt an income approach was more representative because of changes in the industry. That doesn’t mean, however, that if you face an accounting change or error correction, it’s just you, the guidance, and several sleepless nights. Our experts here at Embark are always ready to help you clear whatever accounting hurdles you face, ASC 250 or otherwise.