The process of recording adjustment entries can be complex, but it is essential for maintaining the integrity of financial statements. Non-cash expenses – Adjusting journal entries are also used to record paper expenses like depreciation, amortization, and depletion. These expenses are often recorded at the end of period because they are usually calculated on a period basis. This also relates to the matching principle where the assets are used during the year and written off after they are used. Accrued expenses and accrued revenues – Many times companies will incur expenses but won’t have to pay for them until the next month.

Inventory

- When a company purchases supplies, it may not use all suppliesimmediately, but chances are the company has used some of thesupplies by the end of the period.

- Prepaid insurance is insurance that has been paid for but not yet used.

- To help you master this topic and earn your certificate, you will also receive lifetime access to our premium adjusting entries materials.

- With an adjusting entry, the amount of change occurring duringthe period is recorded.

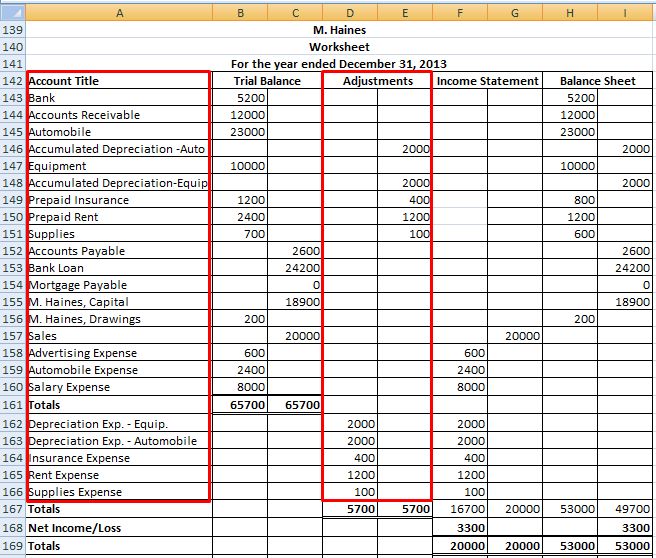

The difference between the asset’s value (cost) andaccumulated depreciation is called the book valueof the asset. When depreciation is recorded in an adjusting entry,Accumulated Depreciation is credited and Depreciation Expense isdebited. Supplies Expense is an expense account, increasing (debit) for$150, and Supplies is an asset account, decreasing (credit) for$150. This means $150 is transferred from the balance sheet (asset)to the income statement (expense). There is still a balance of $250 (400 – 150) inthe Supplies account.

What is your current financial priority?

When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Press Post and watch your fixed assets automatically depreciate and adjust on their own.

Accrual Accounting and Adjusting Journal Entries

Here are the main financial transactions that adjusting journal entries are used to record at the end of a period. Making adjusting entries is a way to stick to the matching principle—a principle in accounting that says expenses should be recorded in the same accounting period as revenue related to that expense. If you use small-business accounting software — like QuickBooks, Xero or FreshBooks — you might not be familiar with journal entries. That’s because most accounting software posts the journal entries for you based on the transactions entered. The two examples of adjusting entries have focused on expenses, but adjusting entries also involve revenues.

Booking the Journal Entries

The purpose of adjusting entries is to show when money changed hands and to convert real-time entries to entries that reflect your accrual accounting. Booking adjusting journal entries requires a thorough understanding of financial accounting. If the person who maintains your finances only has a basic understanding of bookkeeping, it’s possible that this person isn’t recording adjusting entries. Full-charge bookkeepers and accountants should be able to record them, though, and a CPA can definitely take care of it.

Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts, or the inventory obsolescence reserve. In the journal entry, Interest Receivable has a debit of $140.This is posted to the Interest Receivable T-account on the debitside (left side). Interest Revenue has a credit balance of $140.This is posted to the Interest Revenue T-account on the credit side(right side). In some situations it is justan unethical stretch of the truth easy enough to do because of theestimates made in adjusting entries. Doubling the usefullife will cause 50% of the depreciation expense you would have had.This will make a positive impact on net income.

A real account has a balance that is measured cumulatively, rather than from period to period. Payments for goods to be delivered in the future or services to be performed is considered unearned revenue. The same principles we discuss in the previous point apply to revenue too. You should really be reporting revenue when it’s earned as opposed to when it’s received. A third classification of adjusting entry occurs where the exact amount of an expense cannot easily be determined.

Then, in March, when you deliver your talk and actually earn the fee, move the money from deferred revenue to consulting revenue. Suppose in February you hire a contract worker to help you out with your tote bags. In March, when you pay the invoice, you move the money from accrued expenses to cash, as a withdrawal from your bank account. When you generate revenue in one accounting period, but don’t recognize it until a later period, you need to make an accrued revenue adjustment. If you do your own accounting and you use the cash basis system, you likely won’t need to make adjusting entries.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in 18 best hair growth products 2021 according to dermatologists our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Several internet sites can provide additional information foryou on adjusting entries. One very good site where you can findmany tools to help you study this topic is AccountingCoach which provides a tool that is available to you free ofcharge. Visit the website and take a quiz onaccounting basics to test your knowledge. All adjusting entries include at least a nominal account and a real account. At the end of the year after analyzing the unearned feesaccount, 40% of the unearned fees have been earned. You will learn more about depreciation and its computation inLong-Term Assets.